Trade DAX

When you open a CFD trading account with Captainmarkets, you can trade the world’s most popular financial markets, including the renowned DAX index, a benchmark of the German stock market.

Start trading DAX CFDs with Captainmarkets

About DAX

The DAX, known in german language as Deutscher Aktienindex is a popular stock market index that is a trading instrument and a reflection of the German economy. Also known as the Germany 30 or DE30, this index contains 30 major German companies on the Frankfurt Stock Exchange. In the third quarter of 2021, the DAX constituents will be increased to forty companies.

Germany is Europe’s largest economy, and the DAX contains many international brands which play an essential role in the global economy. Notable constituents include BMW, Deutsche Bank, DHL and Siemens.

The symbol for the DAX index varies between brokers and investment firms. At Captainmarkets, we refer to the German stock market index as DAX. Other firms may call it DE30 or GER30. The DAX is quoted against the euro. When you trade DAX CFDs, the base asset is the underlying index, and the quote asset is euros. The standard contract size, often referred to as the Lot size is one index. An important characteristic of trading with Captainmarkets is the smallest order size you can enter is 0.01 Lots, which allows you to trade this volatile instrument with lower exposure.

The Pip value of DAX is one euro. This means, if your order is for 2 Lots, if the price moves up or down by one Pip, the impact to your profit or loss would be €2. Similarly, if your order was for 0.5 Lots, and the price moves up or down by one Pip, the impact on your profit or loss would be €0.50.

One of the benefits of CFD trading is you can use leverage to reduce how much capital required to open positions. Captainmarkets offers up to 1:20 leverage for trading major stock market indices, such as the DAX; therefore, you only need to provide a 5% margin to open a position.

- Base asset: DAX

- Quote asset: euros

- Contract size (Lot size): 1 index (1 Lot)

- Min trade size: 0.1 index (0.01 Lots)

- Max trade size: 1000 indices (100 Lots)

- Pip position: 1.00

- Pip value: €1

- Maximum leverage (margin): 1:20 (5%)

- Trading hours: 09:05-23:00 (Mon-Fri)

Constituents of the DAX index

Since the DAX index was established on the 1st of July 1998, many companies have come and gone. This index contains some of the best-known brands in finance, fashion, pharmaceuticals, technology and the automotive industry.

DAX Trading Insights

- The DAX is highly correlated with other currency pairs which reference the euro, for example, EUR/USD and GBP/EUR have a strong correlation with this index.

- Due to the low number of constituents and lack of diversity, the DAX can be very volatile, which offers both opportunities and risks.

- Low-interest rates cause investors to put their money into riskier assets such as stocks, if interest rates are increased, investors may pull their money from the stock market, and purchase bonds. This causes stocks and therefore, indices to fall in value.

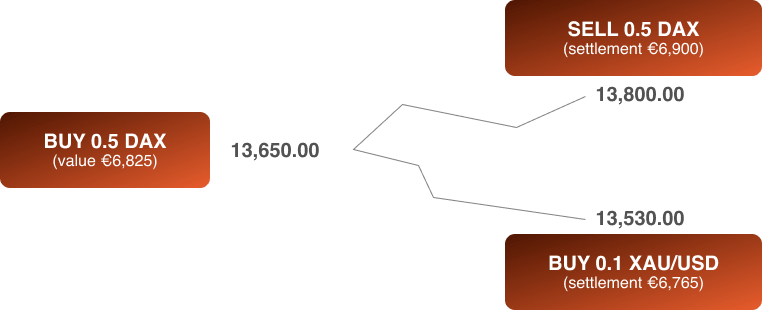

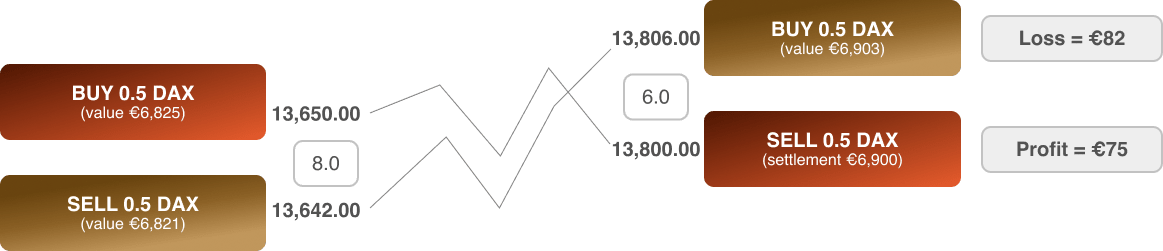

When you go long on the DAX, which means you expect the price to rise, you’re theoretically buying DAX with euros. To close the position, another trade in the opposite direction is used to offset it. Your profit or loss will be determined by the difference in value between the opening and closing orders. If the value of DAX increases, you’d end up with more euros when the position is closed. However, if the value of DAX falls, you’d end up with fewer euros.

With leverage, you can open larger positions than your capital would otherwise permit. When you trade CFDs with Captainmarkets, you can use leverage as high as 1:20; meaning you only need to provide margin to cover 5% of the position’s value.

When you trade CFDs, you don’t need to own either of the assets or currencies involved in the trade. For example, if your trading account balance is funded with pounds, you can still trade DAX. The purpose of a CFD is to allow traders to speculate on an asset’s price without having to purchase it or own it. When a CFD is closed, it will always be settled in cash either by increasing or decreasing your trading balance.

Costs to trade DAX

There are different costs associated with trading CFDs with Captainmarkets. There are three primary factors which influence how much it costs to trade CFDs; they are:

- The size of your trade, the bigger the trade, the higher the fees.

- The instrument you’re trading, as different products have different characteristics.

- The type of account you have, as different accounts have different conditions.

Costs related to trading CFDs

The different costs to be aware of when trading forex CFDs are spreads, commissions and swaps.

Spread

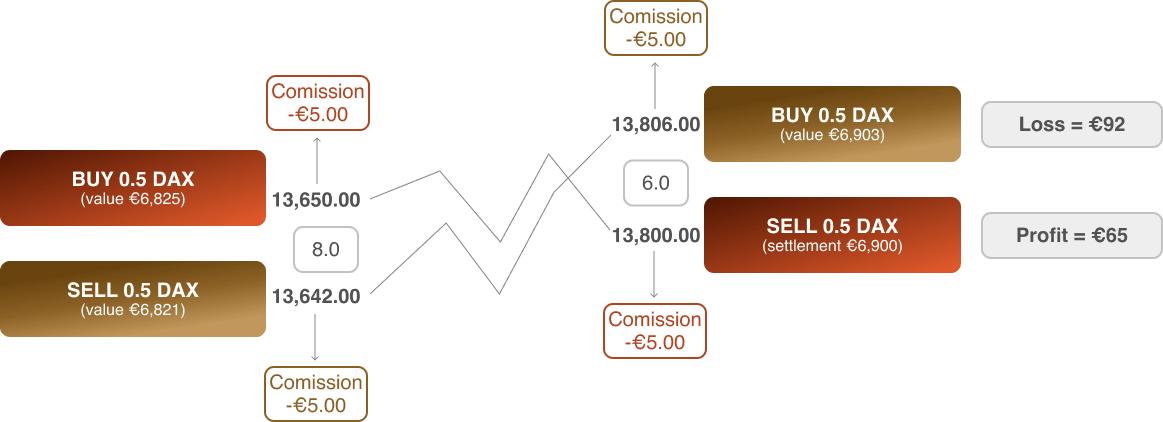

The spread is the difference between the bid and Ask-price. When you enter a long trade, your order is opened using the Ask-price, which is the higher of the two quotes. When the long trade is closed, the Bid-price, which is the lower of the two quotes. If the Ask-price is 13,658 and the Bid-price is 13,650, it means the spread is 8-Pips.

Commission

Commissions are charged when you open and close a trade and therefore impacts your profitability. In this example, the commission charged is €10 per Lot. Once adjusted according to the trade size of 0.5 Lots, the commission becomes €5 on each side of the trade.

Swap

A swap is a fee for holding positions overnight. The fee is derived from the interest rate differential between the base and quote asset. As Bitcoin is not a currency and is therefore not subject to interest rates, consequently the swap fee comes from the US dollar. In this example, the swap rate is $7,875.00 per Lot for both long and short positions.