Trade Bitcoin

Trade Bitcoin CFDs with Captainmarkets

When you open a CFD trading account with Captainmarkets, you can trade the world’s most popular Digital assets, including the legendary Bitcoin.

About Bitcoin

Bitcoin was designed as an alternative payments system that could function independently from any authority, such as a government, central bank or commercial bank. Since its inception in 2008, Bitcoin has been the centre of many controversies. Despite having a vague legal status within the financial ecosystem, Bitcoin has managed to beat the odds and reach adoption levels many never thought possible.

At Captainmarkets, we offer two BTC/USD CFD instruments. One is a standard contract, and the other is a mini contract. When you trade BTC/USD, the base asset is Bitcoin, and the quote asset is US dollars. The standard contract size, often referred to as the Lot size is one BTC; therefore, the smallest order size you can enter is 0.01 BTC. For some traders, that’s too much exposure; therefore, we offer a BTC/USD mini contract. The contract size is 0.01 BTC; hence a micro-Lot is 0.0001 BTC.

BTC/USD is quoted with two decimal places. The second digit is known as the Pip. The value of a Pip depends on the size of the contract. If you open a position for 1 Lot of BTC/USD, the Pip value will be $10, whereas if you open a position for 1 Lot of BTC/USD mini, the Pip value would be $0.10.

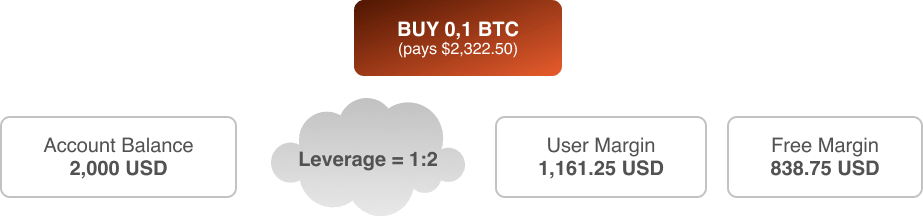

One of the benefits of CFD trading is you can trade with leverage to reduce how much capital needed to open a trade. Captainmarkets offers up to 1:2 leverage for trading BTC/USD, which means you only need to provide a 50% margin to open a position.

- Due to the volatility of Bitcoin, it offers many long and short trading opportunities for active traders to capture.

- The price of Bitcoin is less correlated with other markets which means you can find trade possibilities when there are none in other asset classes.

- The recent stability of the price of BTC suggests it’s no longer the bubble many previously considered it to be.

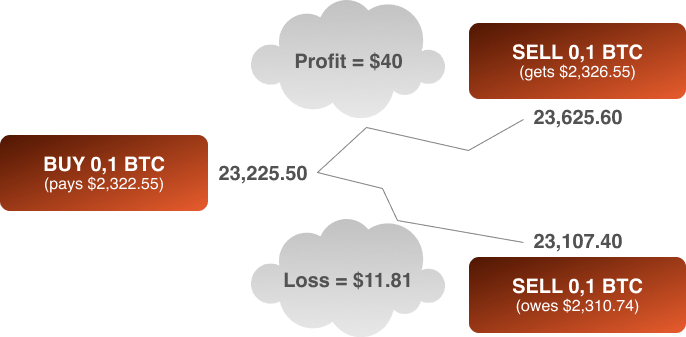

When you go long on BTC/USD, you’re technically buying BTC with dollars. When you close the trade, your profit or loss will be calculated in dollars. If the price of Bitcoin increased against the dollar, you’d get more dollars when you close the transaction. If the price of Bitcoin falls, you’ll get back fewer dollars.

With leverage, you’re able to open larger positions than your capital would otherwise permit. When you trade Digital Currency CFDs with Captainmarkets, you’re able to access leverage as high as 1:2; it means you only need to provide the margin to cover 50% of the position’s value.

When you trade Digital Currency CFDs, you don’t need to own either of the assets or currencies included in the pair. For example, if your trading account balance is funded with British pounds, you can still trade BTC/USD. The purpose of a CFD is to allow traders to speculate on an asset’s price without having to purchase it or own it. When a CFD is concluded, it will always be settled in cash by increasing or decreasing the amount of balance in your trading account.

Costs to trade Bitcoin

Costs to trade BTC/USD

There are different costs involved when trading CFDs with Captainmarkets. There are three primary factors which influence how much you pay for your transactions; they are:

- The size of your trade, the bigger the trade, the higher the fees.

- The instrument you’re trading, as different products have different characteristics.

- The type of account you have, as different accounts have different conditions.

Costs related to trading CFDs

The different costs to be aware of when trading forex CFDs are spreads, commissions and swaps.

Spread

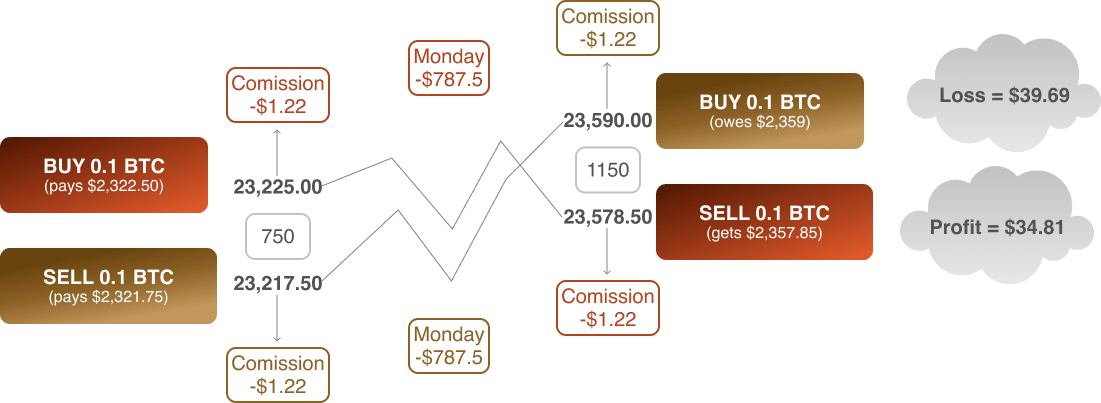

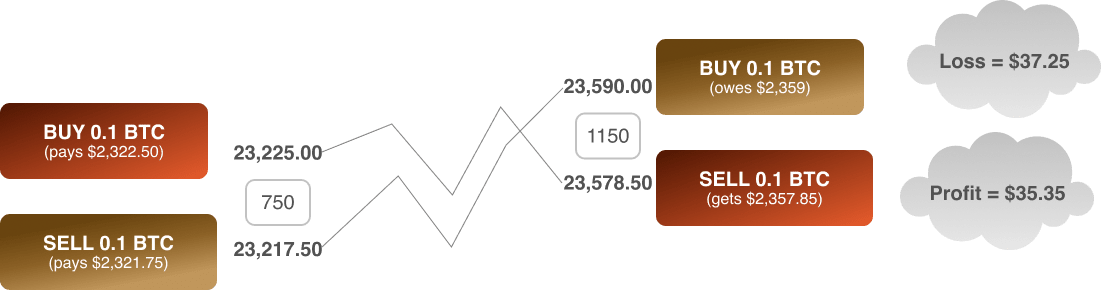

The spread is the difference between the bid and offer price. When you enter a long trade, your order is opened using the Ask-price, which is the higher of the two quotes. When the long trade is closed, the Bid-price, which is the lower of the two quotes. The spread for trading Digital Currencies can become very wide, depending on market conditions.

Commission

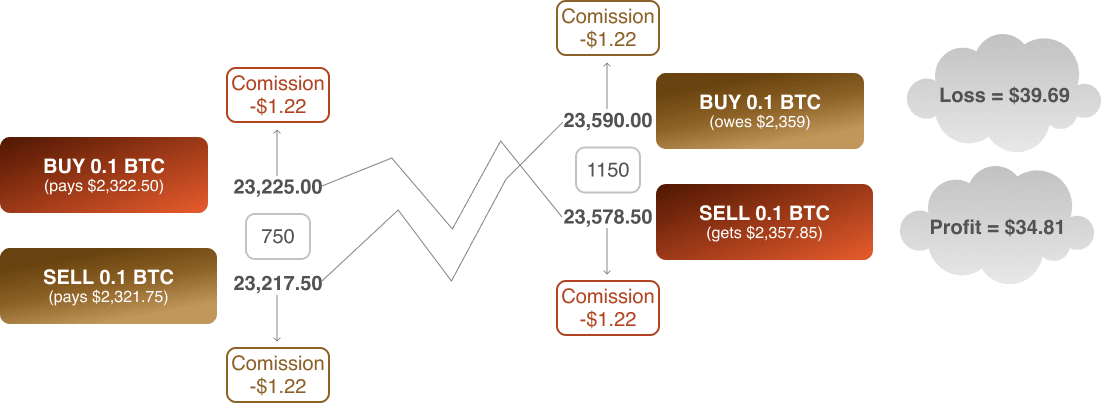

Commissions are charged when you open and close a trade. In this example, the commission charged is €10 per Lot. Once adjusted according to the trade size of 0.1 Lots, the commission becomes €1.00. When converted to dollars using the spot rate, which in this example is 1.22, the commission becomes $1.22.

Swap

A swap is a fee for holding positions overnight. The fee is derived from the interest rate differential between the base and quote asset. As Bitcoin is not a currency and is therefore not subject to interest rates, consequently the swap fee comes from the US dollar. In this example, the swap rate is $7,875.00 per Lot for both long and short positions.